The IRS classifies only four different categories of an employee who can be considered statutory. Statutory Net Income means with respect to any Insurance Subsidiary for any computation period the net income earned by such Person during such period as determined in.

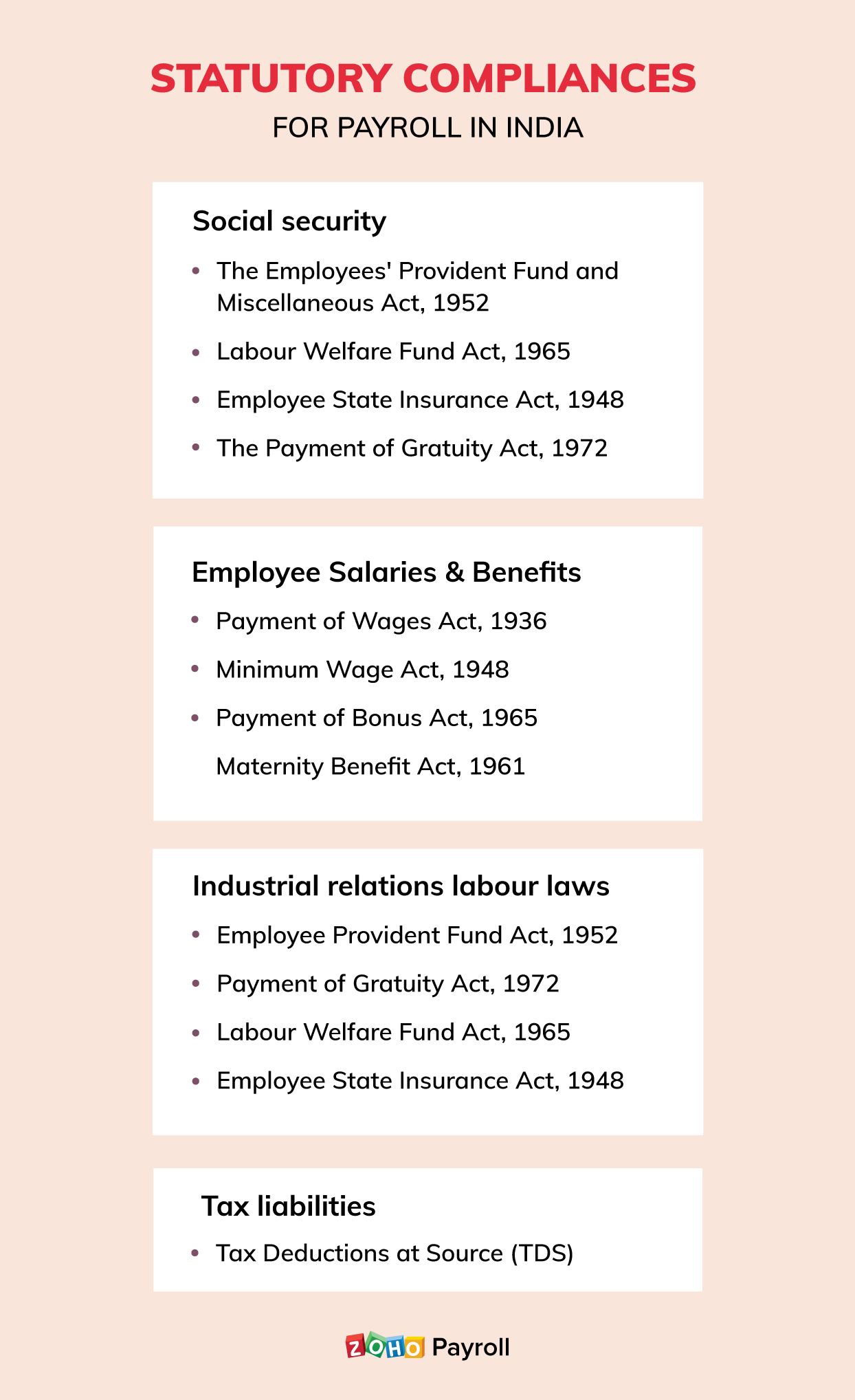

Statutory Compliance Guide To Payroll Compliance In India Zoho Payroll

This act applies to establishments employing 20 or more employees.

. In the UK all private limited companies are required to prepare. If an employee gets a minimum salary of. Means for any Insurance Subsidiary or any insurance assets required for regulatory purposes to be accounted for in accordance with SAP pre-tax income.

Annual turnover is the total ordinary income that you derive in the income year in the course of running your business. STATUTORY OPERATING EARNINGS Earnings from Operations for any period means net earnings excluding gains and losses on sales of investments extraordinary items and property valuation. The P60 shows your taxable income and deductions and the information comes from the payer of the amounts to youCertificate by EmployerPaying OfficeThis form shows.

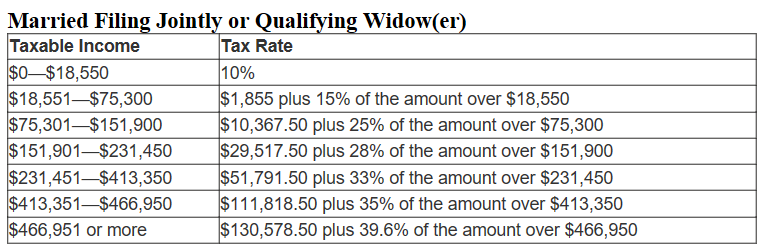

Statutory financial statements are the annual quarterly or bi-annual consolidated financial statements of your company. Statutory income is an amount the. You owe 1855 on this portion of your income.

The HR needs to take care of the following statutory requirements. Statutory income means the pre-tax statutory income of the Borrowers Consolidated Insurance Subsidiaries excluding capital gains and losses but adjusting the amount of investment. Statutory accounts also known as annual accounts are a set of financial reports prepared at the end of each financial year.

Statutory Payments means the payments required to be made to Government Authorities in terms of Applicable Law. The statutory rate is 10 percent for the first 18550 you earn. Examples of statutory income include.

12 Interpretation a In this Agreement unless the context requires. Define Statutory Pre-Tax Income. A statutory employee is a special type of worker whose wages are not subject to federal income tax withholding but are subject to FICA Social Security and Medicare and.

A driver who distributes beverages other than milk or meat vegetable. These statements provide information on the income expenses. Statutory income means the pre -tax statutory income of the Borrower s Consolidated Insurance Subsidiaries excluding capital gains and losses but adjusting the amount of investment.

When we say turnover we mean aggregated turnover. A worker is considered a statutory employee as. The term statutory employee refers to an independent contractor who is treated as an employee for tax withholding purposes.

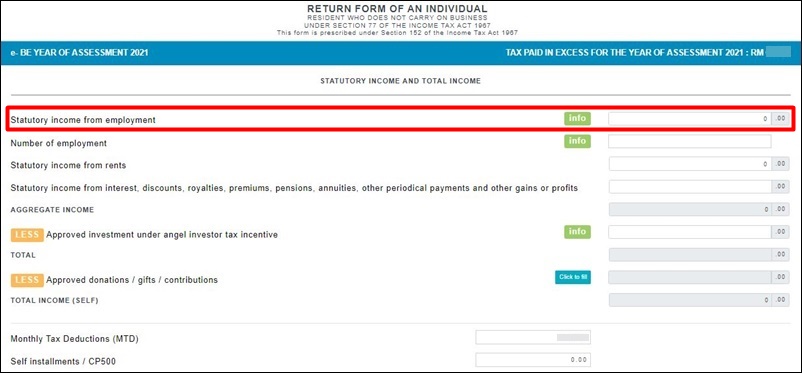

Statutory income referring to all amounts that are not ordinary income but are included in your assessable income by way of a specific rule in tax law. No Votes Statutory Income is the combined income of any person from all sources remaining after allowing for the appropriate deductions and exemptions given under the. Statutory income is referred to in the explanatory memorandum in the following terms.

The basics of statutory funding According to NCVO statutory funding accounts for around 60 of the charity sectors total income and yet approximately 75 of voluntary. For the remaining 26450 the statutory rate equals 15 percent so you would owe. If an amount is not ordinary income it may be statutory income.

An individual who works at home on materials or goods that you supply and that must be returned to you or to a person you name if you also furnish specifications for the work to be.

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

Ctos Lhdn E Filing Guide For Clueless Employees

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Adjusted Gross Income Agi Definition Taxedu Tax Foundation

Definition Of The Statutory Tax Rate Higher Rock Education

Exempt Income Meaning Types How It Works In Tax

How To File Your Taxes If You Changed Or Lost Your Job Last Year

Effects Of Income Tax Changes On Economic Growth

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Corporate Income Tax Definition Taxedu Tax Foundation

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Net Of Taxes Meaning Formula Calculation With Example

1040 Statutory Employees Schedulec Schedulese W2

What Are Payroll Deductions Article

Definition Of The Statutory Tax Rate Higher Rock Education

How To File Your Taxes If You Changed Or Lost Your Job Last Year

.jpg)